🧠 Introduction: Why You’re Still Broke (and It’s Not Your Fault)

Let’s be real — most people are stuck in the broke cycle. Paycheck comes in, bills go out, and by the 20th of the month, you’re wondering where all your money went 😩.

The truth?

It’s not just about how much you earn — it’s about how you think, what you do with your money, and whether you’re ready to break free from the system designed to keep you stuck.

So if you’re tired of saying “I’m broke” every week…

This post is your wake-up call 🚨.

🔍: The Broke Mindset – How It Holds You Hostage

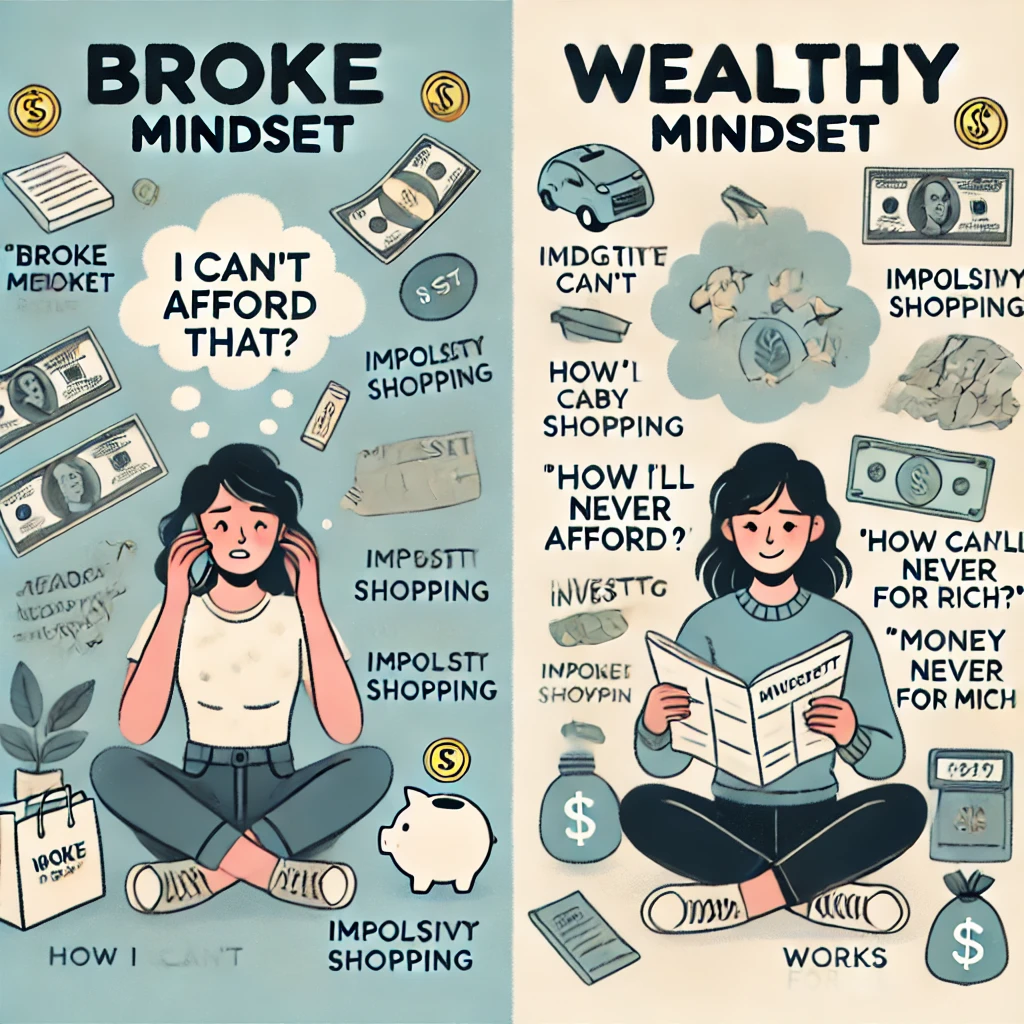

Being broke isn’t always about having low income. It’s about:

- Living paycheck to paycheck

- Spending money to “look rich” instead of building wealth

- Thinking saving is impossible

- Believing you need to “get lucky” to succeed 💭

This is the broke mindset, and it’s silently keeping millions trapped.

Example:

You buy the newest phone 📱 on EMI but don’t have an emergency fund.

You go out every weekend 🍻 but complain about gas prices.

That’s broke behavior — and it’s gotta go.

💣: 7 Reasons You’re Still Broke (Even If You Work Hard)

1. ❌ No Budget = No Plan

You can’t manage what you don’t track. If you’re not budgeting, you’re bleeding money every month.

2. 🕳️ Lifestyle Inflation

Got a raise? You started spending more. Instead of saving the extra, your lifestyle grew — not your bank balance.

3. 🧾 Too Much Debt

Credit cards, loans, BNPL — they’re all traps if you don’t control them.

4. 🧠 Lack of Financial Education

Schools don’t teach this. Most of us were never taught how to save, invest, or build wealth.

5. 🔁 Living for Instant Gratification

Why wait to save when you can order in? Why invest when that new outfit’s calling? This cycle = broke forever.

6. 🛒 Emotional Spending

Bad day? Shopping spree.

Good day? Celebrate with a big purchase.

You see the pattern?

7. 😴 No Second Income

In 2025, if you’ve got one income, you’re one step away from broke. Period.

💡: How to Escape the Broke Cycle for Good

✅ 1. Budget Like a Boss

Use apps like YNAB, GoodBudget, or even a Google Sheet.

Track every rupee, dollar, peso — whatever you earn.

📌 Tip: Follow the 50/30/20 rule → 50% Needs | 30% Wants | 20% Saving & Debt

✅ 2. Build an Emergency Fund

Save at least 3-6 months of expenses. Start with just ₹500 or $10/week. It stacks up. This is your broke-proof shield 🛡️.

✅ 3. Get Out of Debt (Fast)

Use the Snowball Method (smallest to biggest) or Avalanche Method (highest interest first).

Destroy your debt and reclaim your income 💥.

✅ 4. Learn About Money

Spend 10 mins daily on finance blogs, YouTube, or podcasts.

Knowledge is wealth. Literally.

👀 Start here: [Your Blog Name]/budgeting-guide

Or search: “FinanceDiddy Budgeting” 🔍

✅ 5. Start a Side Hustle

Freelance, sell stuff, teach online, start a blog, do affiliate marketing — just start.

More income = more freedom 🔓.

✅ 6. Stop Flexing for the Gram

That “rich look” is costing you your actual wealth.

The goal is to be rich in silence, not broke out loud 💯.

🧭: Simple Habits That Build Wealth Over Time

- ✍️ Write down your expenses daily (even just in Notes app)

- 📅 Automate savings/investments each month

- 💳 Use credit cards wisely – don’t carry a balance

- 🎯 Set weekly money goals (e.g., save ₹500, no eating out)

🔚 Final Thoughts: Being Broke Isn’t a Personality – It’s a Phase 💪

It’s not about shaming yourself.

It’s about being aware, taking tiny steps daily, and refusing to stay stuck.

You don’t need a million-dollar idea.

You need a plan, a purpose, and the courage to say:

“I’m done being broke.”

🔗 Want More?

Check out our full Budgeting Guide, Money Habits, and Side Hustle Ideas here:

👉 financediddy.com

💬 Got questions? Drop a comment or DM us on IG.

Let’s break the broke cycle — together 💥

INSTAGRAM- CLICK HERE