Introduction: Why Investing is the Smartest Way to Build Wealth

Are you tired of living paycheck to paycheck? Do you want to make your money work for you instead of just saving it in a bank account with barely any interest? If so, investing is the key to achieving financial freedom. Investing can help you build wealth over time, protect against inflation, and create opportunities for a comfortable future.

This guide is designed for beginners who are looking to take their first steps in investing. We’ll break down the basics, explain different investment options, and give you the tools to start growing your money the smart way.

Chapter 1: Understanding the Basics of Investing

1.1 What is Investing?

Investing is the process of putting your money into assets (like stocks, bonds, or real estate) that have the potential to grow in value over time. Unlike saving, where your money remains stagnant, investing allows you to earn returns, helping your wealth multiply.

1.2 The Power of Compound Interest

Albert Einstein famously called compound interest the “eighth wonder of the world.” It works by reinvesting your earnings, so your money keeps growing over time. For example:

- If you invest $1,000 with an annual return of 10%, after one year, you’ll have $1,100.

- If you leave that money invested, in 10 years, it can grow to $2,593 without adding any more funds!

1.3 Investing vs. Saving: What’s the Difference?

| Feature | Investing | Saving |

|---|---|---|

| Potential Growth | High | Low |

| Risk Level | Medium to High | Low |

| Time Horizon | Long-Term | Short-Term |

| Best for | Building Wealth | Emergency Funds |

If you want to build wealth and beat inflation, investing is essential.

Chapter 2: Types of Investments and Where to Start

2.1 Stocks: Owning a Piece of a Company

Stocks represent ownership in a company. When you buy a stock, you own a small fraction of that business.

- Pros: High return potential, passive income through dividends.

- Cons: Can be volatile, requires research.

2.2 Bonds: Safer, Steady Income Investments

Bonds are loans you give to governments or corporations in exchange for periodic interest payments.

- Pros: Lower risk, steady income.

- Cons: Lower returns compared to stocks.

2.3 Mutual Funds & ETFs: Diversified Investing

Mutual funds and ETFs (Exchange-Traded Funds) are collections of stocks and bonds managed by professionals.

- Pros: Diversification reduces risk, managed by experts.

- Cons: Management fees, limited control over individual assets.

2.4 Real Estate: Tangible Investment for Passive Income

Real estate investing involves buying properties to generate rental income or resell at a profit.

- Pros: Physical asset, rental income, appreciation in value.

- Cons: High upfront costs, maintenance responsibilities.

Chapter 3: How to Start Investing as a Beginner

3.1 Setting Financial Goals

Before you start investing, ask yourself:

- What is your goal? (Retirement, buying a house, financial freedom)

- How much risk can you tolerate?

- What is your investment timeline?

3.2 Opening a Brokerage Account

To buy stocks, ETFs, and ot jher assets, you need a brokerage account. Some popular brokers include:

- Robinhood (Great for beginners, commission-free trades)

- Fidelity (Comprehensive research tools)

- Vanguard (Best for long-term investing)

3.3 How Much Money Do You Need to Start Investing?

Contrary to popular belief, you don’t need thousands of dollars to start investing. Some brokers allow you to start with as little as $10!

3.4 Investment Strategies for Beginners

- Dollar-Cost Averaging (DCA): Invest a fixed amount regularly to reduce risk.

- Buy & Hold: Keep investments for long-term growth.

- Index Investing: Invest in ETFs that track the overall market.

Chapter 4: Managing Risk and Avoiding Common Mistakes

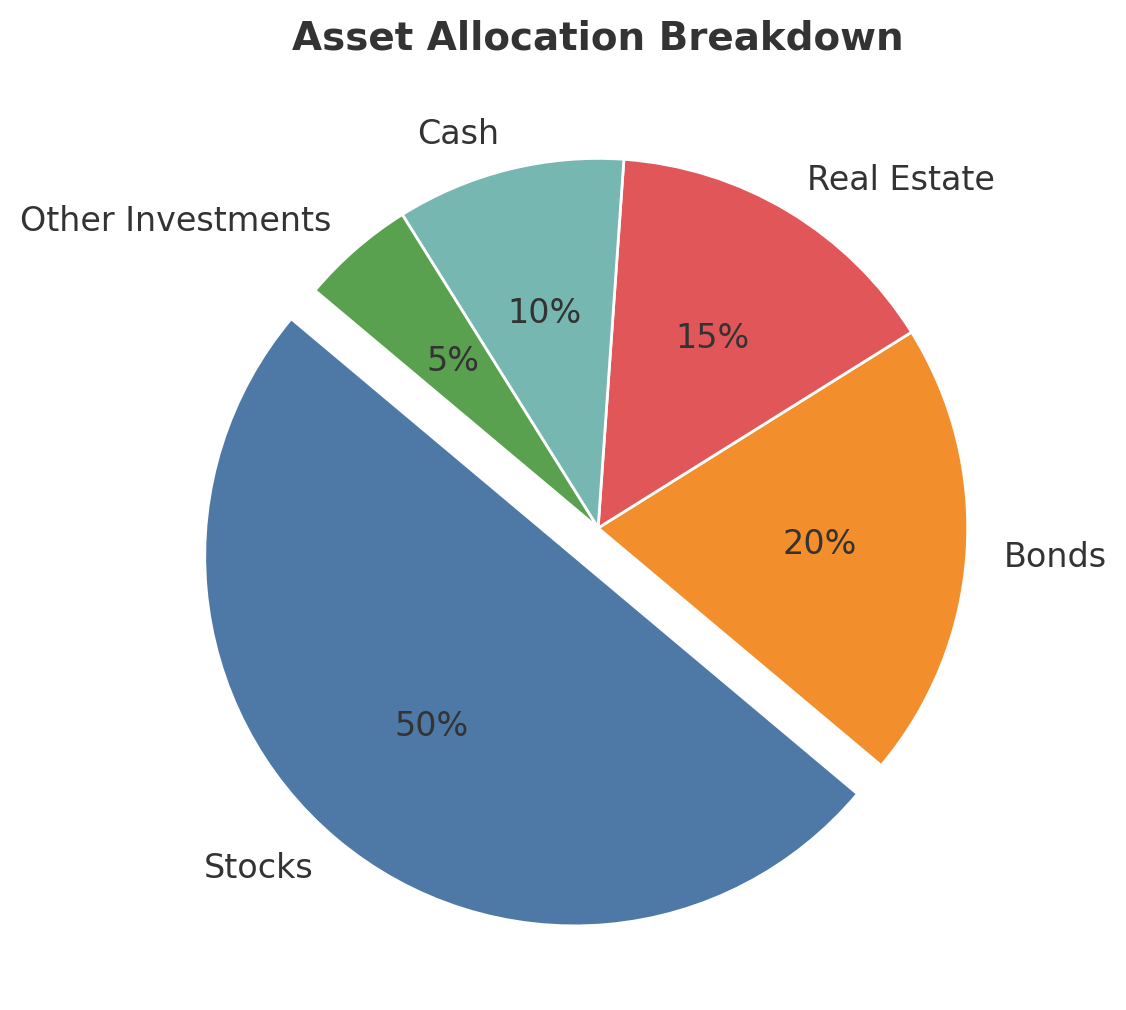

4.1 Diversification: Don’t Put All Your Eggs in One Basket

Spread your investments across different asset types to minimize risk.

4.2 Avoiding Emotional Investing

Don’t let emotions control your decisions. Stick to your strategy, even during market downturns.

4.3 Watch Out for Scams

Avoid “get-rich-quick” schemes. If something sounds too good to be true, it probably is.

Chapter 5: Growing Your Investments and Reinvesting Profits

5.1 The Importance of Reinvesting

Reinvesting your earnings helps compound your growth over time.

5.2 When to Sell Your Investments

- When you reach your financial goal.

- If an investment is performing poorly due to bad fundamentals.

- If you need funds for an emergency.

5.3 Continuing Your Investment Education

Successful investors never stop learning. Follow finance blogs, read books, and keep up with market trends.

Conclusion: Your Journey to Financial Freedom Starts Now

Investing is a powerful tool that can help you build wealth and achieve financial independence. The key is to start now, stay consistent, and keep learning.

If you found this guide helpful, make sure to share it with others who want to grow their money the smart way! 🚀

IF YOU WANT TO LEARN ABOUT BUDGETING HERE IS MY FULL GUIDE FOR IT- (CLICK HERE)