Introduction

Let’s be real — the word “budget” alone is enough to make some people cringe.

It sounds restrictive, boring, and full of spreadsheets you don’t understand.

But here’s the truth: budgeting is not about deprivation — it’s about control.

If you’ve ever:

- Felt like your paycheck disappears too fast,

- Avoided checking your bank account out of fear,

- Or wanted to save, but just didn’t know how…

Then you’re in the right place.

This guide will walk you through how to build a realistic budget, even if numbers make your head spin. No jargon. No complicated math. Just simple steps anyone can follow to finally feel in charge of their money.

Step 1: Know Where Your Money Goes

Before you build a budget, you need to track where your money is actually going.

Action Steps:

- Look at your last 30 days of bank statements

- Write down all your expenses (or use a free app like Mint, YNAB, or Goodbudget)

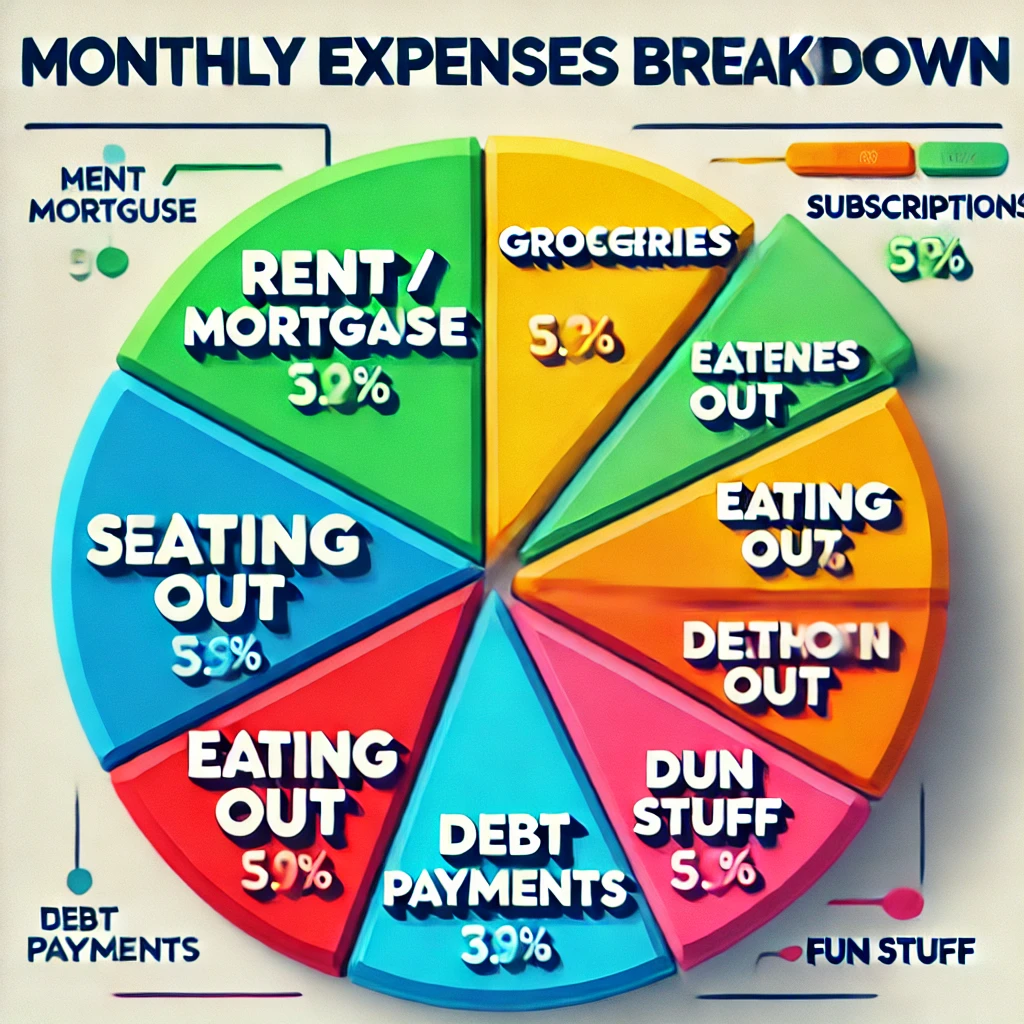

- Group them into categories like:

- Rent/mortgage

- Groceries

- Subscriptions

- Eating out

- Transportation

- Debt payments

- Fun stuff

Step 2: Find Your Monthly Income

This part is simple: how much money are you bringing in each month?

Include:

- Salary (after tax)

- Freelance/side hustle income

- Child support/alimony

- Passive income (dividends, etc.)

🧠 Pro Tip: If your income varies, average out the past 3–6 months to get a base.

Step 3: Choose a Budgeting Method That Doesn’t Suck

There’s no one-size-fits-all budget.

Here are 3 beginner-friendly styles:

1. The 50/30/20 Rule

- 50% Needs (rent, bills, groceries)

- 30% Wants (dining out, Netflix, etc.)

- 20% Savings/Debt Repayment

2. The Zero-Based Budget

Every dollar has a job. Income – Expenses = 0

Great for people who love details.

3. Pay Yourself First

Save a set amount as soon as you get paid.

Spend what’s left after that.

💡 Start with the 50/30/20 — it’s flexible, simple, and easy to stick with.

Here’s a sample budget using the 50/30/20 rule:

| Category | % | Amount (Based on ₹60000/mo) |

|---|---|---|

| Needs | 50% | ₹30000 |

| Wants | 30% | ₹18000 |

| Savings/Debt | 20% | ₹12000 |

Step 5: Track & Adjust Weekly

Budgeting isn’t “set it and forget it.”

Check in weekly:

- Are you overspending in one area?

- Did you forget about an upcoming expense?

- Can you cut something small to save more?

🎯 Think progress, not perfection. You won’t get it perfect from Day 1 — and that’s okay.

Common Budgeting Mistakes to Avoid

- ❌ Forgetting annual expenses (car insurance, holidays)

- ❌ Being too strict (you’re not a robot)

- ❌ Ignoring it after one bad week

- ❌ Not budgeting for fun (leads to burnout)

How to Make Budgeting Fun (Seriously)

Yes, it can be fun. Try:

- Turning it into a game — “How much can I save this week?”

- Rewarding yourself when you hit savings goals

- Doing it with a partner or friend (budgeting brunch, anyone?)

Final Thoughts: Budgeting is a Skill, Not a Talent

You weren’t born knowing how to budget — no one was.

Like any skill, it gets easier the more you do it.

By following the simple steps in this guide:

- You’ll stop guessing where your money goes

- You’ll stop living paycheck-to-paycheck

- And you’ll start building the life you actually want

No shame. No stress. Just a plan that works — even if you hate math.

Ready to Take Control of Your Money?

Start today.

Open a blank doc, create your first simple budget, and watch how good it feels to be in control.

🔁 Bookmark this guide and come back any time you need a refresh.

✅ You got this.